Commercial users of solar thermal energy systems, including those from PowerPanel and other manufacturers, are expected to benefit from the new legislation.

While the majority of the renewable energy industry is bracing for the deep cuts and clawbacks in Federal tax incentives for residential solar electric systems, one segment expects to thrive from the same changes: hybrid solar/thermal installations on commercial buildings.

The reason: the new legislation restores a 100% bonus depreciation for a category known as Section 179D, which applies to a commercial building’s energy efficiency measures related to the building envelope, interior lighting, and—most significantly—HVAC and water heating systems. Previously at just a 40% depreciation allowance, this increase is expected to boost sales and installations of solar thermal hot water generation systems since they fully qualify under the rules. This accelerated depreciation is on top of other incentives, such as the 30% Federal Investment Tax Credit (ITC) plus an additional 10% Made in America bonus, stacking multiple financial advantages for commercial building owners and developers.

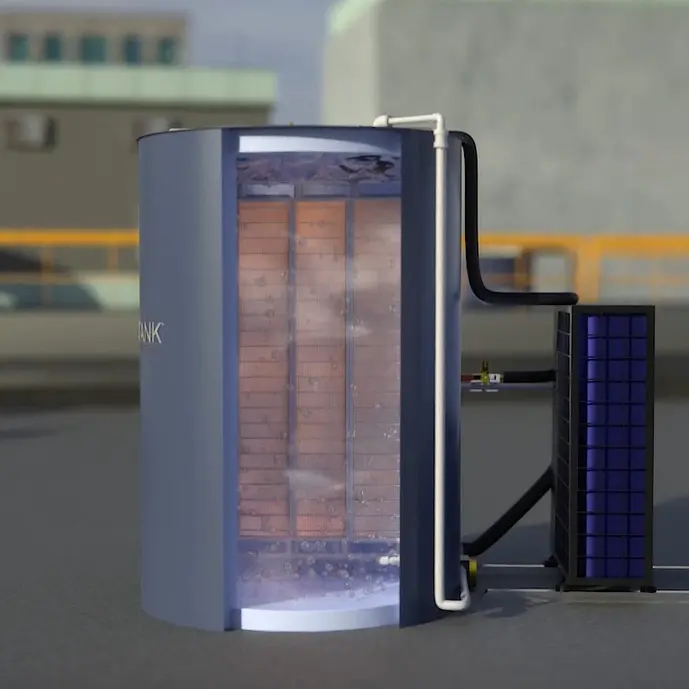

Michigan-based PowerPanel is one such company in that space that is looking forward to making progress as a result. The firm designs and builds hybrid Made-in-U.S.A. energy systems to support and augment both new and existing “legacy” hot water generation and storage systems as well as HVAC plants, for buildings in applications ranging from health care and hospitality facilities to multi-family housing, office and school buildings—anywhere an ample, continuous supply of hot water is critical to operations. The PowerPanel system works by harnessing two energy streams, solar thermal plus solar electricity, to heat water while also reducing operating costs.

What that means for PowerPanel and other companies in this solar thermal energy space is that while some incentives for solar electricity implementation might decline, the field is actually now more open and even-leveled (alternative to “levelized”) for solar thermal systems. Newly-enhanced Section 179D provisions in the ‘Big Beautiful Bill’ might transform the economics of investing in a sustainably-generating hot water system, through its accelerated depreciation provisions along with energy-efficient building incentives. For producers of hybrid energy technologies and systems, it should be a ‘win-win’ in terms of both achieving sustainability goals as well as meaningful tax and cash flow benefits.

To help building owners, operators and developers take full advantage of the new rules in effect and navigate all the provisions of Section 179D, PowerPanel is hosting free educational webinars on the subject called Unlocking Tax Savings With Sustainable Hot Water Systems. Attendees will learn how they can use the 100% bonus depreciation and Section 179D deductions by implementing a hybrid solar/thermal hot water system to support their operations. It will be based on PowerPanel’s global experience implementing this type of energy system, from the Caribbean to Asia and the Pacific.